Starting a business is always tough. But it gets tougher when it comes to finding the money you need. But here’s some good news: crowdfunding is on the rise across the world. But how to do crowdfunding in India? We’ll get to it for sure, but let’s see some figures first.

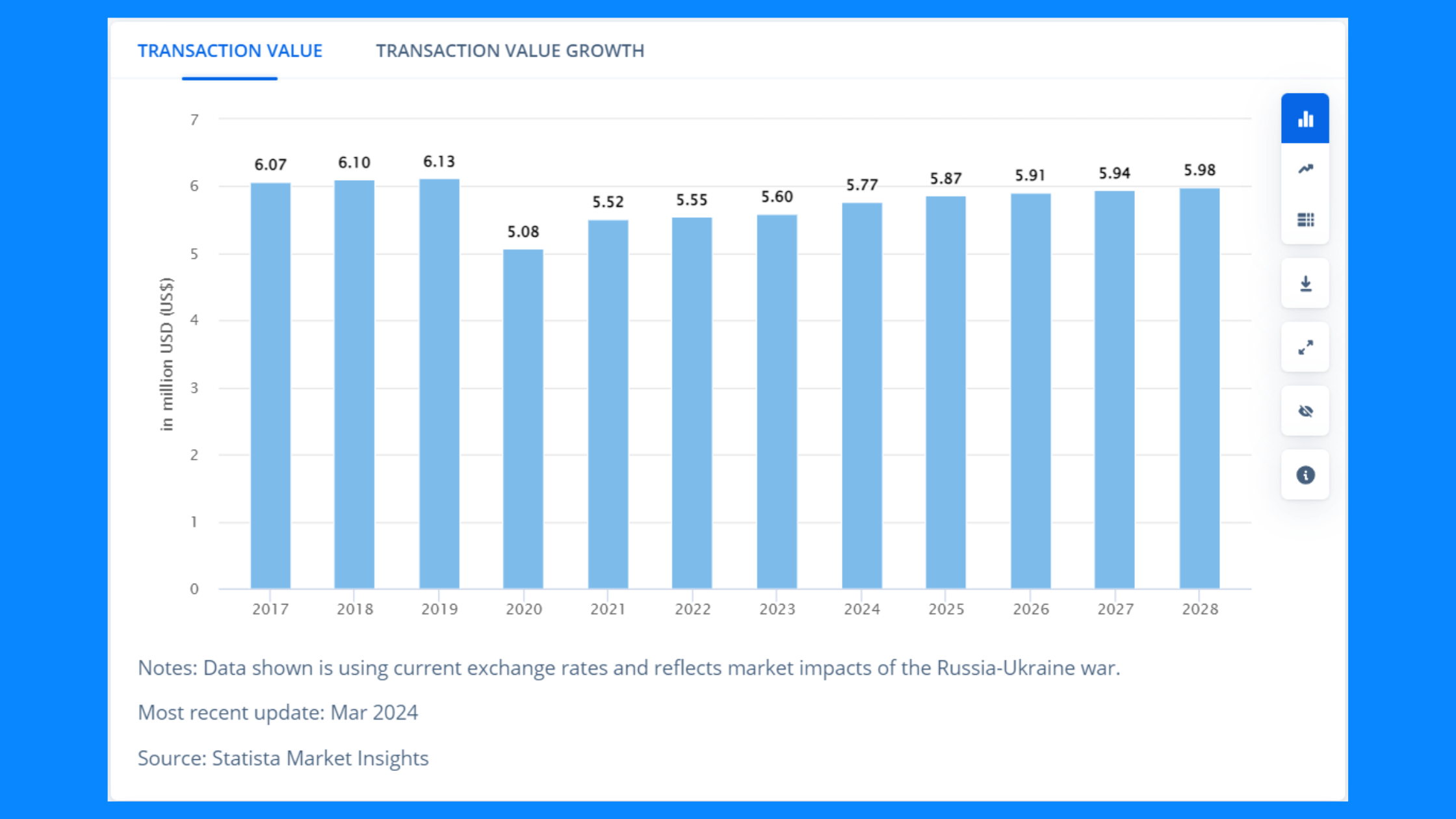

By the end of 2024, the crowdfunding market in India is projected to reach $5.77 million, with the average campaign raising about $3,800. That’s a lot of potential support for your startup!

What’s better than sharing your idea with a large audience and gathering the funds you need from people who believe in your vision? Whether you’re just starting or looking to grow, this guide will show you how to use crowdfunding to turn your startup dreams into reality.

What is Crowdfunding?

Crowdfunding is a way to raise money by asking a large number of people to contribute a small amount. Instead of seeking a big check from a single investor, you get lots of small contributions from a community of supporters. Crowdfunding has grown rapidly, especially in India, thanks to the internet and social media.

Crowdfunding works by allowing you to present your business idea on a crowdfunding platform. You create a campaign that tells your story, explains your idea, and shows how the funds will be used.

Backers, or supporters, browse through these campaigns and choose the ones they want to support. Each backer contributes a small amount, and when enough people pitch in, you reach your funding goal.

In India, popular crowdfunding platforms like Ketto, Milaap, and Wishberry have helped many startups get off the ground. These platforms provide a space where you can connect with potential backers, share updates, and keep everyone engaged and excited about your project.

How Does Crowdfunding Work?

If you haven’t been living under a rock and are active on social media, you must’ve seen TikToks, reels, or shorts about crowdfunding for businesses. But we’ll not leave things to chance.

Let’s learn how to do crowdfunding for your business. Here’s a step-by-step guide to help you get started.

- Choose the Right Platform: Select a crowdfunding platform that fits your needs. Platforms like Ketto and Wishberry are popular in India and have different features and fees.

- Create Your Campaign: Build a compelling campaign page. This should include a catchy title, a detailed description of your project, and high-quality images or videos. Make sure to explain why your startup is unique and how the funds will be used. If it’s hard, hire a landing page copywriter.

- Set a Realistic Funding Goal: Decide how much money you need to raise. Be realistic and transparent about your funding goal and what it will cover. This helps build trust with your potential backers.

- Offer Rewards: People love getting something in return for their support. Offer rewards or incentives based on the level of contribution. This could be anything from a thank-you note to exclusive early access to your product.

- Promote Your Campaign: Share your campaign on social media, send emails, and talk about it everywhere. The more people you reach, the better your chances of hitting your funding goal.

- Engage with Backers: Keep your backers updated on your progress. Respond to their questions and thank them for their support. Building a strong relationship with your backers can lead to more support and even future customers.

Want to learn how to do crowdfunding purely off of social media? Here are the steps:

- Create a custom page that has all the details about your business.

- Set up a payment gateway on the landing page to collect payments.

- Integrate a system to create the records of each funding and details of the investors

- Create content on social media platforms like Instagram, YouTube, Linkedin, etc. to market your business for crowdfunding.

You must’ve seen countless videos asking for crowdfunding. It’s high time you try the same!

3 Types of Crowdfunding

Now you know what crowdfunding is and how it works. But when learning how to do crowdfunding in India, it’s important to know the different types as well.

Each type has its benefits and is suited for different kinds of projects. Let’s get into it:

1. Reward-Based Crowdfunding

In reward-based crowdfunding, backers contribute money in exchange for rewards. These rewards can be products, services, or other incentives.

- Examples: A tech startup might offer early access to a new gadget. An artist might give signed prints or exclusive content.

- Pros and Cons: This type of crowdfunding is great for engaging with your community and building a customer base. However, this won’t work if you have a B2B product or anything that is of no use to the backers.

2. Equity-Based Crowdfunding

Equity-based crowdfunding allows backers to invest in your company in exchange for shares. They become part-owners and can share in your success.

- Regulations in India: In India, equity crowdfunding is regulated to protect investors. Make sure to comply with all legal requirements.

- Pros and Cons: This method can raise a lot of money and provide valuable business connections. But giving away equity means sharing control of your company. And you also need to have all the paperwork in place.

3. Debt-Based Crowdfunding

Also known as peer-to-peer lending, debt-based crowdfunding involves borrowing money from backers, which you agree to repay with interest.

- Examples: This is often used for projects with a clear plan for revenue, like expanding an existing business.

- Pros and Cons: You retain full ownership of your company, but you need to make regular repayments. It’s a good option if you have a solid business plan and predictable cash flow. It isn’t advisable to have debt-based crowdfunding if you don’t have an existing cashflow.

When Should You Choose Crowdfunding Instead of Other Funding Options?

In one of our previous articles, I talked about types of Startup Funding. But it didn’t answer this question. So, here we go:

Deciding on the right funding method for your startup can be challenging. Crowdfunding has unique advantages that make it an attractive option, but it’s not always the best choice for every situation.

Let’s see when crowdfunding might be the best fit for your startup compared to other funding options like venture capital, angel investing, and bank loans.

- Early-Stage Startups: If you’re in the early stages of your startup, crowdfunding can be a great way to validate your business idea. By presenting your concept to a large audience, you can gauge interest and receive feedback. If people are willing to back your project with their money, it’s a good sign that your idea has potential.

- Building a Community: Crowdfunding is particularly useful when you’re building a community of supporters. The backers can become your first customers, brand advocates, and sources of valuable feedback. Unlike traditional investors who are mainly interested in financial returns, backers on crowdfunding platforms are often passionate about the product or cause.

- Marketing and Exposure: A successful crowdfunding campaign can generate significant buzz and media attention. Platforms like Ketto and Wishberry provide a public stage for your project, helping you reach a wider audience. This exposure can lead to additional opportunities and partnerships that might not have been possible through traditional funding methods.

- Flexibility and Control: Compared to equity-based funding options like venture capital and angel investing, crowdfunding allows you to retain more control over your startup. With reward-based or debt-based crowdfunding, you don’t have to give away a share of your company. This can be crucial if you want to maintain full ownership and decision-making power.

- Low Financial Risk: Traditional bank loans require regular repayments and come with financial risk, especially if your startup doesn’t generate immediate revenue. Crowdfunding, particularly reward-based, carries less financial risk as you’re not required to repay the funds. You only need to deliver the promised rewards to your backers.

Conclusion

The biggest benefit of crowdfunding, in my opinion, is it not only helps you raise the funds but also allows you to build a community, validate your idea, and gain exposure. Whether you’re in the early stages of your startup or looking to launch a specific project, crowdfunding offers flexibility and a lower financial risk compared to traditional funding methods.

I hope this article helped you understand the different types of crowdfunding and when to choose it over other options.

FAQs

What is crowdfunding?

Crowdfunding is a method of raising money by asking a large number of people to contribute a small amount, typically via the Internet.

How to do crowdfunding in India?

To do crowdfunding in India, choose a suitable platform like Ketto or Wishberry, create a campaign, set a realistic funding goal, offer attractive rewards, promote your campaign, and engage with your backers.

What are the types of crowdfunding?

The three main types of crowdfunding are reward-based, equity-based, and debt-based crowdfunding.

What are the legal requirements for crowdfunding in India?

For equity-based crowdfunding, comply with SEBI regulations. Reward-based and debt-based crowdfunding have fewer regulatory requirements but ensure transparency and honesty in your campaign.

How much money can be raised through crowdfunding?

The amount varies based on your campaign’s appeal and reach. On average, campaigns in India can raise around $3,800, but successful campaigns can raise significantly more.

Can a failed crowdfunding campaign affect my startup’s reputation?

A failed campaign can impact your reputation if backers feel misled. Transparency, regular updates, and delivering on promises can mitigate negative effects.

![Top 5 Personal Branding Examples [2024]](https://fueled.community/wp-content/uploads/2024/05/Source-Proideators.com-9-551x431.png)

Leave feedback about this